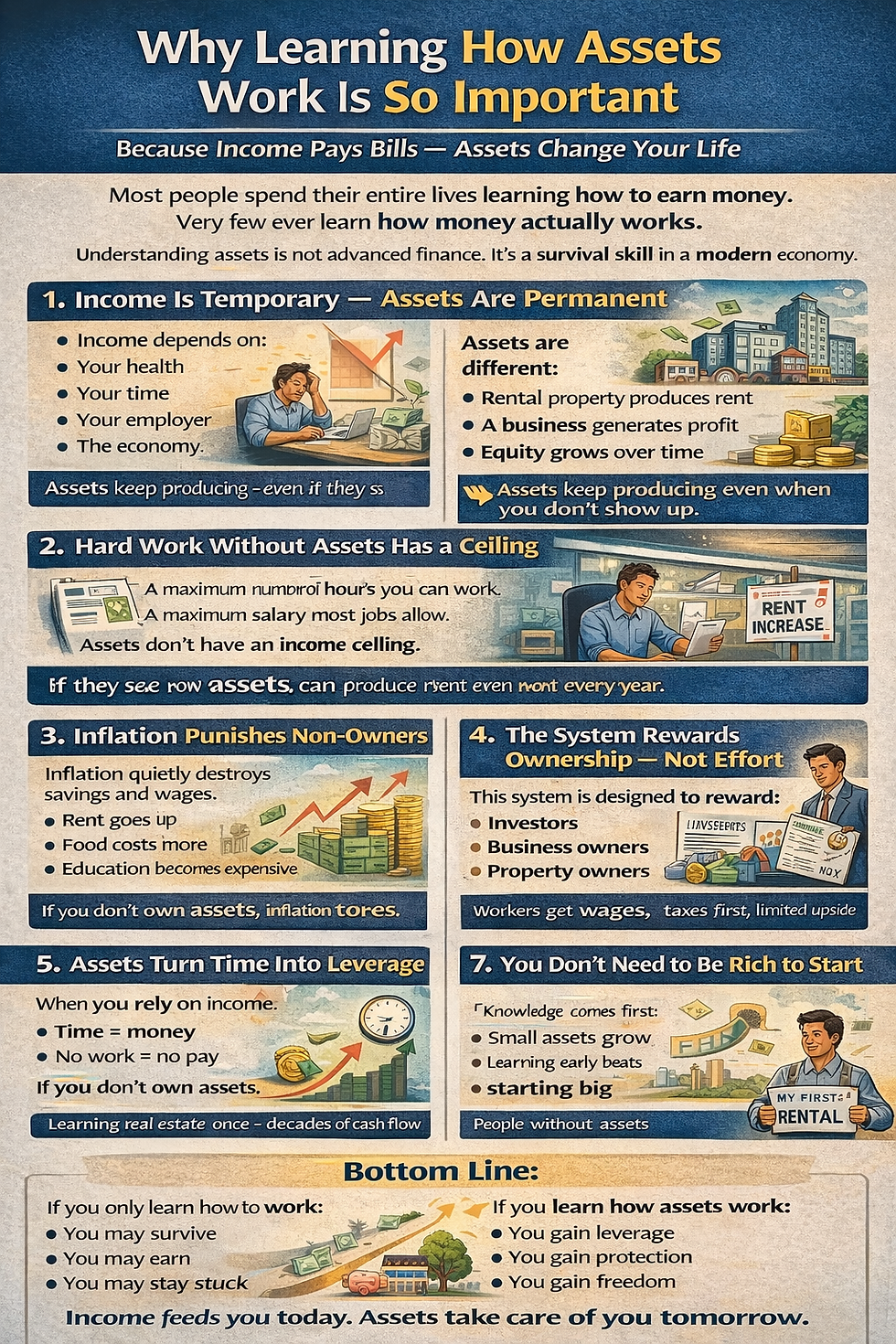

Why Learning How Assets Work Is So Important

- TJ Kim

- Jan 4

- 2 min read

Because Income Pays Bills — Assets Change Your Life

Most people spend their entire lives learning how to earn money.

Very few ever learn how money actually works.

That difference is the gap between:

Working forever

And eventually having money work for you

Understanding assets is not advanced finance.It’s a survival skill in a modern economy.

1. Income Is Temporary — Assets Are Permanent

Income depends on:

Your health

Your time

Your employer

The economy

If you stop working, income stops.

Assets are different:

Rental property produces rent

A business generates profit

Equity grows over time

👉 Assets keep producing even when you don’t show up.

Without assets, you are always one problem away from financial stress.

2. Hard Work Without Assets Has a Ceiling

There is a maximum number of hours you can work.There is a maximum salary most jobs allow.

That’s the income ceiling.

Assets don’t have that ceiling:

One property can become two

One business can open more locations

One investment can compound for decades

People who build wealth don’t work harder forever.They build systems that scale.

3. Inflation Punishes Non-Owners

Inflation quietly destroys savings and wages.

Rent goes up

Food costs more

Education becomes expensive

Salaries lag behind

Assets often benefit from inflation:

Property values rise

Rents increase

Businesses adjust prices

If you don’t own assets, inflation works against you.If you do, it often works for you.

4. The System Rewards Ownership — Not Effort

This is uncomfortable, but true:

The system is designed to reward:

Investors

Business owners

Property owners

Not employees.

Owners get:

Tax deductions

Depreciation

Leverage

Equity growth

Workers get:

Wages

Taxes taken first

Limited upside

Learning how assets work means learning how the rules are written.

5. Assets Turn Time Into Leverage

When you rely only on income:

Time = money

No work = no pay

Assets convert:

One-time effort → long-term return

Examples:

Learning real estate once → decades of cash flow

Building a business → recurring income

Investing early → compounding

This is how people escape constant hustle without burning out.

6. Assets Create Choices — Not Just Money

Money is not the real goal.

Assets give:

The ability to say no

Time with family

Flexibility during crisis

Dignity in old age

People without assets:

Fear layoffs

Fear illness

Fear retirement

People with assets:

Have options

Freedom comes from ownership.

7. You Don’t Need to Be Rich to Start

This is the biggest myth:

“Assets are for rich people.”

Reality:

Knowledge comes first

Small assets grow

Learning early beats starting big

Most wealthy people:

Started with little

Learned how assets work

Repeated simple principles consistently

Bottom Line

If you only learn how to work:

You may survive

You may earn

You may stay stuck

If you learn how assets work:

You gain leverage

You gain protection

You gain freedom

Income feeds you today. Assets take care of you tomorrow.

Comments