What 20 Years of Business Taught Me About Money

- TJ Kim

- Jan 10

- 3 min read

Lessons You Can’t Learn From Books or Classes

After 20 years in business, one truth stands out clearly:

What I believed about money at the beginning was mostly wrong.

I thought money was about:

Intelligence

Hard work

Making the “right” decisions

What business taught me instead is far less glamorous — and far more useful.

Money doesn’t respond to motivation.It responds to behavior, structure, and time.

Here are the most important lessons two decades of real-world business taught me about money — lessons that cost years, stress, and mistakes to learn.

1. Money Is Emotional Before It Is Logical

Early on, I assumed money decisions were rational.

They’re not.

Most financial decisions are driven by:

Fear

Ego

Pride

Anxiety

Desire to look successful

I’ve seen smart people:

Overexpand to impress others

Avoid necessary cuts to save face

Chase growth instead of stability

The biggest money mistakes rarely come from lack of knowledge.They come from unmanaged emotion.

2. Cash Flow Matters More Than Profit

Profit looks good on paper.Cash keeps the lights on.

Over the years, I watched profitable businesses fail — including some of my own ventures — for one reason:

They ran out of cash.

Rent, payroll, inventory, and taxes don’t care about:

Future growth

Long-term vision

“Profitability on paper”

If money doesn’t arrive on time, none of that matters.

Cash flow isn’t accounting.It’s survival.

3. Revenue Is Vanity — Liquidity Is Power

In the beginning, I chased revenue.

Big numbers felt like progress.

But revenue without liquidity creates:

Stress

Fragile businesses

Forced bad decisions

Liquidity gives you:

Time to think

Room to negotiate

The ability to say no

The businesses that survived downturns weren’t the biggest.They were the most liquid.

4. Risk Is Inevitable — Timing Is Everything

I used to think avoiding risk was smart.

Business taught me:

Risk is unavoidable. Poor timing is optional.

The same decision can be:

Brilliant at one time

Disastrous at another

Expanding too early is just as dangerous as expanding too late.

The lesson wasn’t “take more risk” or “avoid risk.”It was learn when to move — and when to wait.

5. Hard Work Multiplies Systems — Not the Other Way Around

For years, I worked harder whenever money problems appeared.

That works — briefly.

Long term, money improves only when:

Systems improve

Processes stabilize

Decisions become repeatable

Hard work without systems leads to burnout.Systems without discipline collapse.

Money rewards structured effort, not raw hustle.

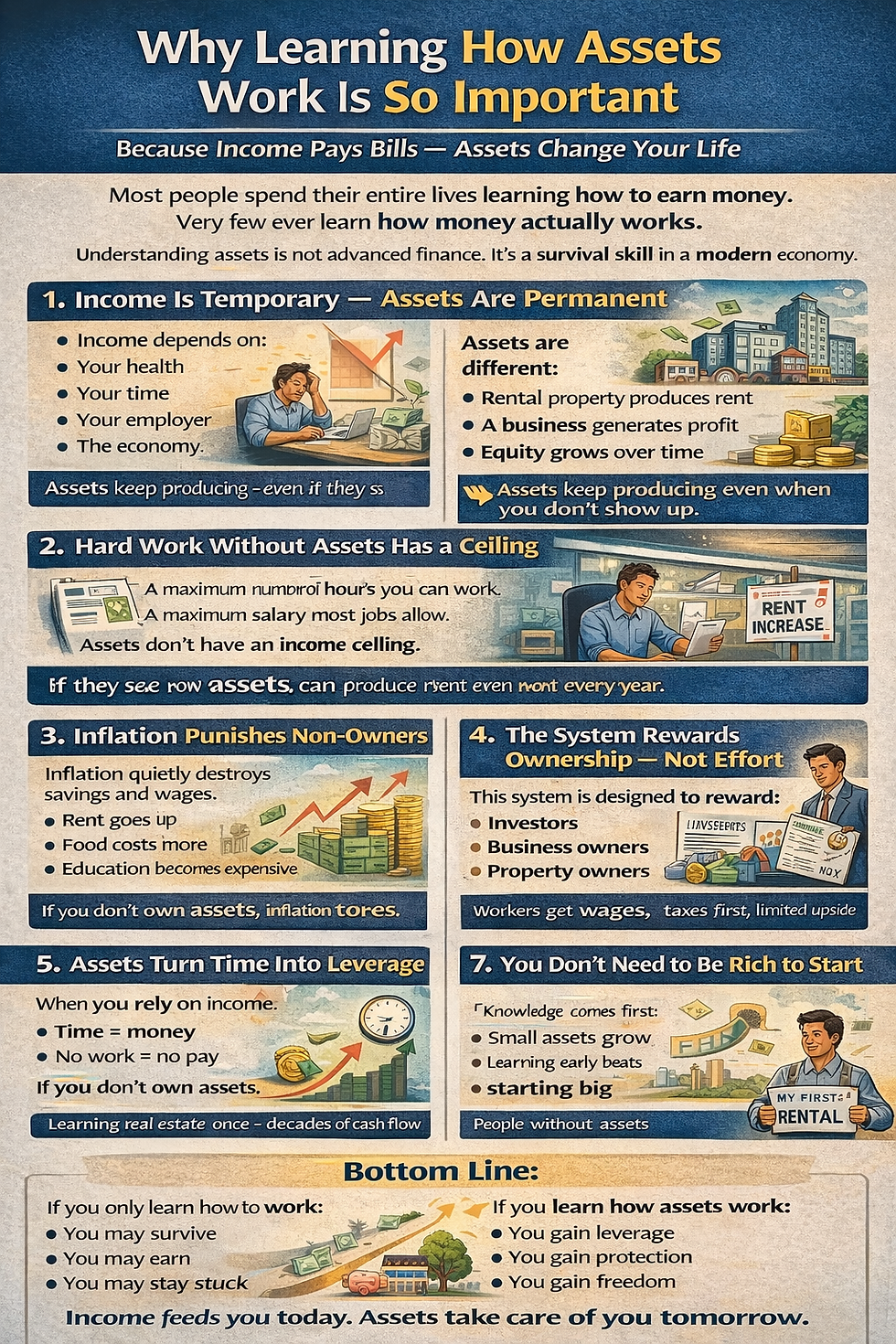

6. Ownership Changes How Money Behaves

As an employee, money arrives and disappears.

As an owner:

Money can compound

Equity can grow

Assets can work while you sleep

Ownership doesn’t eliminate stress — but it changes the rules.

The biggest financial shift in my life wasn’t earning more.It was owning more.

7. The Goal Isn’t More Money — It’s Fewer Bad Decisions

I once believed success meant making brilliant moves.

Twenty years later, I see it differently.

Most success comes from:

Avoiding catastrophic mistakes

Surviving long enough

Staying disciplined during boring periods

Money grows when you stay in the game.

8. Time Is the Ultimate Advantage

The biggest advantage I didn’t appreciate early enough was time.

Time smooths mistakes

Time compounds effort

Time rewards consistency

Those who last longest often win — not because they’re smarter, but because they didn’t quit.

Final Truth After 20 Years

Money isn’t impressed by:

Intelligence

Ambition

Intentions

It responds to:

Behavior

Structure

Timing

Patience

Most financial success isn’t about doing extraordinary things.It’s about doing ordinary things consistently — for a very long time.

Closing Thought

If I could go back 20 years, I wouldn’t tell myself to:

Work harder

Take bigger risks

Chase faster growth

I would say:

Protect cash. Build systems. Own assets. And stay longer than everyone else.

That’s what money rewards in the end.

Comments